Payroll can be fairly straight-forward for some lines of business. Construction is not one of those businesses.

A construction company has to consider a whole range of variables when preparing for payroll. Because construction involves many different types of work, you have to manage multiple pay rates. An expert electrician, a beginner electrician, a plumber, and a general laborer will likely all have different rates. Payroll will be as diverse as the jobs your company takes on.

You may have different pay arrangements to handle as well. You could have a few employees that work on a project-by-project basis, some who are salaried, and others who receive an hourly wage.

Construction is a unique industry because it's made up of so many diverse trades. That means that a company isn't just dealing with one union, they're potentially dealing with several.

It's important to keep track of each type of employee according to their specific job title, work assignment, union affiliation, and benefits. A big job might involve working with a few different unions. This requires you to be aware of union agreements, pay rate for skilled labor, benefits, and overtime rates. You may have additional documentation to fill out, depending on the union.

Unions add a whole new layer of regulation and rules to follow. If you run afoul of their policies, it could create a conflict. So, even though dealing with the extra details makes payroll a lot more complex to manage, it is necessary to keep business moving forward as usual.

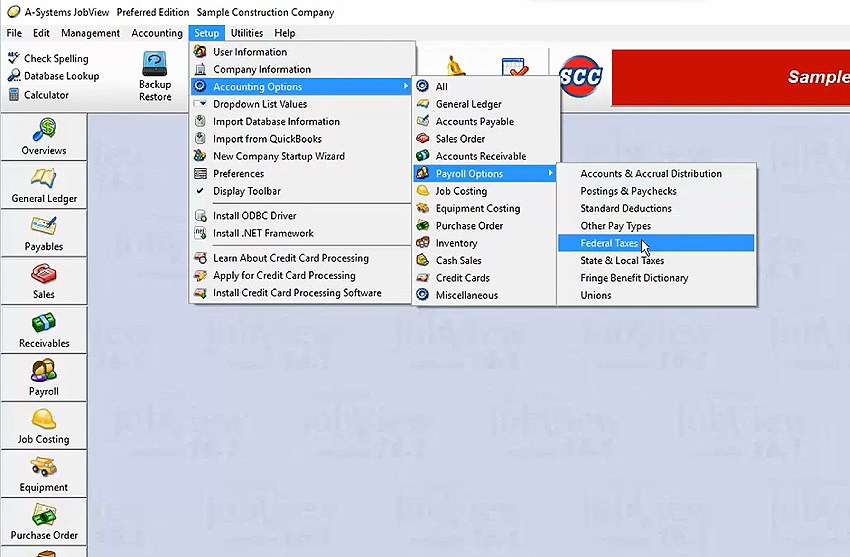

Using A-Systems JobView, you can manage multiple unions. The software holds a dictionary of fringe benefits that can be applied to the various unions, depending on their agreements. Using this dictionary, you can build a benefit package for each union.

In some cases there are deductions, such as union dues that need to be paid by the employee. A-Systems JobView can handle that as well. As you set up your package of benefits, you can select whether payment needs to be made by the employer or by the employee, and the software will take care of the rest.

There are labor laws on both the local and federal level that must be considered. As far as federal laws go, you have the Fair Labor Standards Act (FLSA), which governs what an employer must pay for overtime and minimum-wage. There's the Equal Pay Act (EPA), which means an employer must be sure to pay people fairly, and not discriminate based on gender. An employer would need to carefully assess what type of work each employee is doing to make sure their being paid fair and square, according to the government.

Local labor laws may have higher minimum-wage requirements than what is required on a federal level. For example, California tends to have higher than average pay requirements. States may also require employers to pay for sick leave. Some companies may choose to do so voluntarily as well.

It may not happen often, but occasionally a company will cross a state border for a job. This means that labor laws and taxes are going to vary slightly for those employees. Adjustments will need to be made to make sure you don't upset any state governments.

In addition to state and federal taxes, there are a number of other things that need to be deducted from each employee's check:

There are a number of agencies that are involved with payroll rules and regulations.

Using a good accounting software will help you manage the various tax regulations. A-Systems offers free tax tables, which are automatically downloaded into the software.

The best way to manage your construction company's payroll is with software that is built for the job. A-Systems JobView was built for construction, and is a major time saver for busy managers.

A-Systems knows the ins and outs of construction accounting, so you don't have to stress about the little details.

A-Systems allows you to customize payroll options and save time.