Job costing (aka: job cost accounting) is an accounting process where financial activity is categorized into separate projects. It is commonly used by construction companies to track jobs individually, rather than collectively.

As income and expenses are recorded, they are associated with a specific project. Actual costs are tracked and compared to budgeted costs in order to monitor profitability. This allows a company to see a detailed view of a job's status. The project budget is typically derived from an estimate of job costs, which is made when bidding on a job.

As a company pays bills, subcontracts, and payroll, job costs are naturally accumulated. When those job costs are expensed, they are matched against the budgeted amounts for each part of the job. This allows you to see if you are on budget for each phase of a project.

When costs are out of line, management can track down the cause. They can answer questions like: Is a change order necessary? Were we double billed? Did we pay an invoice twice? Why does one crew always manage to require twice the estimated hours on job after job when the other crews are always within budget?

Expenses are organized by costs codes. A cost code is a number that represents a specific type of work done on a project. For example, the cost code for electrical outlets is 16-300. In your estimate, you can assign a budget of $400 to cost code 16-300. This includes the labor and materials. When the outlets are actually installed for $380, those expenses are assigned to cost code 16-300. Now you can easily compare budgeted costs to actual costs to see that you are still on budget for that particular part of the job. This is extremely helpful for narrowing down where expenses are getting out of hand. Without cost codes and good accounting software, you may not know you're over-budget until the project is completed. Job costing allows you to see the status of each phase in real-time, so adjustments can be made early on.

When variances are caused by changes in the job specifications, a Change Order may be required, which will adjust the job budget and the amount that will be billed to the owner.

Software can also use algorithms to calculate a percentage of completion for each cost code, and then forecast a cost to complete each phase of each job. This can show you cost variance before it happens. Of course, actual information from field reports may be used in place of software-generated forecasts to use manually forecasted costs to complete.

In summary, job costing is monitoring profitability on each job. It's done by accumulating and comparing actual job costs, and then forecasting cost-to-completion.

The function of accounting software is to track actual costs, compare them to the budgeted costs, and provide information about whether there is a variance between the two. Job costing can be used for the full spectrum of jobs, from monitoring costs of a multi-year project down to tracking costs on jobs so small that they are completed in less than a day. The goal is cost control.

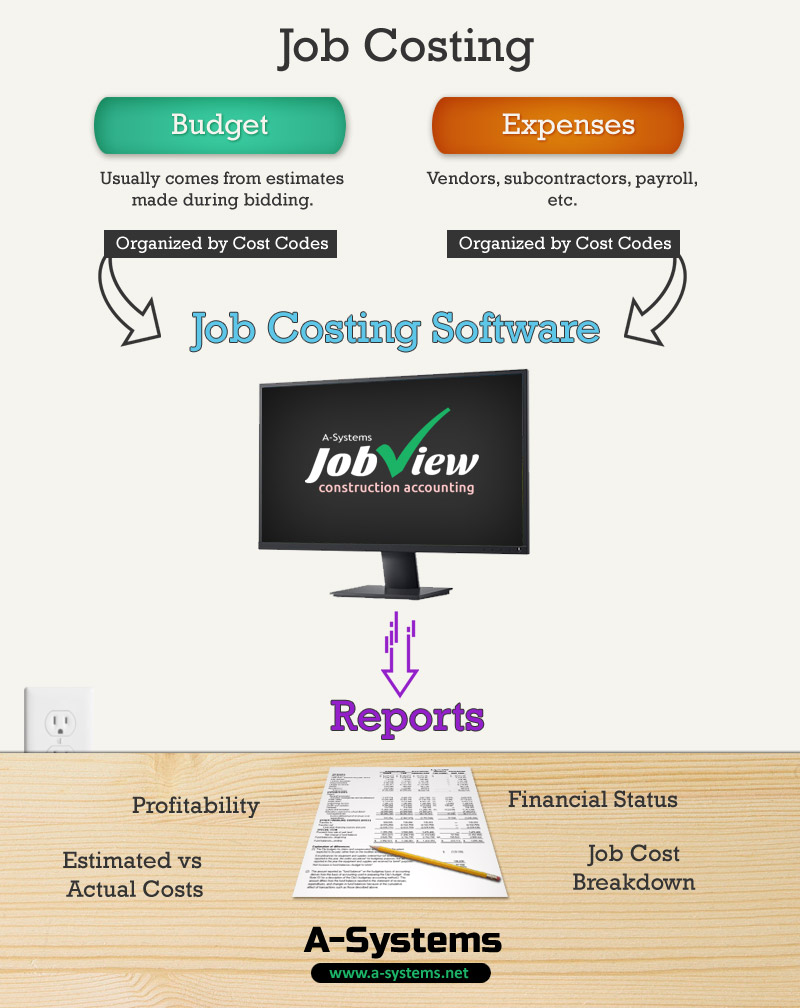

The software works like this:

• Enter the budget for a job, which means take the estimate and use it as the budget.

• Pay the bills for the job, assigning the costs to the appropriate budget category.

• Print reports that show how actual expenses compare to what was budgeted.

• Find problems in time to correct them, obtain Change Orders, etc.

• Make a profit.

A-Systems has made accounting software specifically for the construction industry since 1978.

Job cost accounting is a management tool, a tool designed to monitor and control costs. As a by-product of job cost accounting, the company handles its financial reporting, bonding, payroll, accounts payable, accounts receivable, purchase orders, inventory, W-2s, 1099s, and so on.

The key to job cost accounting is categorizing each phase of each job into a separate budget. A numbering system, called Cost Codes, is used to track labor, materials, equipment costs, subcontractors, and a catch-all “other” category. The industry standard was developed by the Construction Specification Institute, the CSI Cost Code System. With this system, every phase of every job has its own individual budget where actual costs can be compiled. Complex jobs can have budgets for thousands of Cost Codes, while a simple job may have a dozen or so. Costs can be tracked in as much detail or as little detail as desired.

Most people assume that the best time to switch accounting software is at their year-end. Here is the reality: That's when the accounting people are at their busiest season, closing books, doing W-2s, filing year end tax reports, doing year-end adjustments, AND now they have to implement new software too??!

Being practical, the best time to switch to software is almost any time except the year end. Yes, people do it, and they live through the stress, but it's not necessary. How is it done when it's not year end?

Here is a fact that will surprise few contractors: Construction is the highest risk industry in the US economy. There are more business failures in construction than any other industry, both in number and as a percentage. The reason for this gloomy statistic is the reality that most contractors fail to monitor construction costs, so they get out of control. Before the contractor knows it, a job has lost money and the business has deteriorated toward insolvency. If things are not turned around, the owner's home is soon being foreclosed on and another marriage ends up in divorce court. It's ugly!

In response to this risk, some contractors reason that the best solution is to keep their business small, thereby reducing the risk of failure. Surprisingly, the same study that documented how risky construction was (done by the US Small Business Administration) also concluded that staying small actually increased the odds that a contractor would fail. In fact, of all the industries in the study, the one that benefited most by growth was construction!

How can a contractor monitor costs AND grow, thereby increasing the chance for success? The answer is to use job costing. There is an old axiom, "Use the right tool for the job." When it comes to construction, the right tool for accounting is job costing. Taking that a step further, they need to use software meant for REAL job costing to do it right.

An accountant once said, "Contractors that don't use job costing are either lucky or bankrupt." It's a bold statement, but it makes a fair point. If you don't know where you stand on each part of a job, you're relying on luck to get by.

One contractor called A-Systems with profit problem. He had just finished a job that he bid with a $100,000 built-in profit. He complained that when he paid the last bill, instead of making $100,000, he had lost $120,000. His big concern was that he had no idea where things went wrong, so he didn't know what to fix! Fortunately, we were able to get him setup with A-Systems software, which helped him avoid unwanted surprises from future jobs.

If a contractor is using accounting software and actual costs get out of line, there is still time to find out why. This should be an ongoing process, not done after the fact. Was more work done than was originally budgeted? Only by knowing that costs are out of line can management address the causes on a timely basis. Job costing allows management to monitor and thereby control costs. The result is reduced risk, increased profitability, and something sweet, something called "success." Job costing is more than a tool that contractors need in order to avoid becoming a statistic; it is the key to their success.

In actual practice, setting up a budget is not as complicated as it might sound. Estimators do it all of the time. In fact, the Construction Specification Institute (CSI) cost codes were created to help contractors budget and track costs.

Logically, an estimate is not a single figure, but a series of small estimates, each covering a different phase of the job. For instance, how much concrete at what cost per yard will it take for the foundation? How many hours of labor, at what cost per hour to prepare and then pour the foundation? What will the costs be for subcontractors, if any? Will it be necessary to rent some equipment, like a concrete pump, and what will it cost? Each of these estimates is assigned to a cost code.

Each phase of each job has a potential budget for labor, material, subcontracts, equipment, and a general, catch-all "other" category. In addition, there may be a "burden" category, which adds a portion of general and administrative overhead to each job, thereby spreading the whole cost of operation back to each job. This is a powerful way to determine if each job is carrying its share of the load.

The next step is nothing special. In fact, the accountant does what the accountant always does: Enter vendor invoices and subcontractor billings, enter payroll, and do customer billings as usual. As costs are "accrued," they are tracked by cost code. "Accrual accounting" recognizes the expenses as soon as they are incurred, not waiting until they are paid. With accounting software, it is not necessary to actually pay an invoice or a payroll for that cost to be included.

Now you have a budget for a specific job that is categorized by cost code. Your expenses for that job are also categorized with corresponding costs codes. Your software can easily compare the budgeted expenses with the actual expenses and show you where you may be out of line.

Job costing differs from general accounting processes in that it keeps track of actual costs, job by job, phase by phase, line by line, allowing precise monitoring and better control. It is an invaluable tool to contractors because the number one reason for failure in construction is costs getting out of control, resulting in losses. Using the right tool in the accounting office is as important as it is at the construction site.

General accounting uses the general ledger with subledgers, such as accounts payable, accounts receivable, and payroll. When there is a budget for expenses, it is based on the general ledger. When job costing is used, general ledger expenses are budgeted also, BUT job expenses are budgeted individually, job by job, phase by phase, line by line, using cost codes, not the general ledger. What shows on the general ledger are totalled costs for labor, materials, equipment, subcontracts, and other costs. The details of these job costs are tracked in the job costing module, similar to the way details are tracked for accounts receivable, payable, etc.

While it is conceivable that one could use the general ledger to track job costs, it would require a complex, ever expanding chart of accounts to separate and track jobs. A set of numbers would need to be added to the general ledger with every new job. Accounting software simplifies the process by tracking job costs within a job costing module.

No! The process of job costing is quite simple. In fact, it does nothing more than take everything you are already doing and put it together, in a single fully-integrated set of accounting functions.

First, the estimate (which is done by those visionary individuals with detail-oriented minds) is entered into the accounting software. Second, bills are paid and payrolls are made. Third, the job costing information is a by-product of what has already been done: Estimating and paying bills.

Doing job costing requires nothing new. What it does is integrate what is being done into a single piece of software. In the end, it is a simplification of the accounting process, which results in very useful information.

When it comes to controlling costs, it is the best way to do accounting.

Absolutely. At least, that's what those using it say. In fact, most companies are very pleased with job costing for two reasons. The first reason is that they have actual costs versus budgeted costs at their fingertips whenever they want it. It is this kind of knowledge that gives them the power to control job costs.

The second reason is important too. Many companies moving from general accounting to job costing software find their time to be very productive, so much so that they were able to reduce their staff, saving money. One company reported to A-Systems that they went from 60 hours per week doing accounting to less than 40. In fact, the accountant had so much time on her hands, she started doing the job costing for her brother on the side.

Another company had 11 people in their accounting department while using a very expensive accounting program. When they moved to A-Systems JobView, and did real job costing, they immediately dropped from 11 to 8 people. As they got used to the program, they dropped to 5 people. They reported that they no longer needed as many people to do data entry, generate reports, and generally keep their job costing current. What pleased them the most was that they stopped using spreadsheets to do their job costing. They saved enough money that the software paid for itself every few weeks! Using job costing was not a "bother" to them.

Accrual Accounting: To account for income that has not been received or expenses that have not been paid. This is the process that accomplishes the accounting ideal of recognizing income and expenses in the period they are actually incurred to calculate an accurate “net profit” for that period.

Billings in excess of costs: To account for billings that are in advance of what has actually been completed or earned on a job. This is a necessary step to adjust income to what has actually been earned on an “accrual” basis.

Budget or Job Budget: In job costing, the estimate is used, line by line, as the budget for the job. Each step in the job is budgeted and actual expenses are accumulated against that budget to monitor cost variances.

Cash Basis Accounting: To account for income only as it is received and to recognize expenses only when they are paid. While this is a “simple” way of keeping books, it is unreliable as an indicator of profitability because what is owed to you and by you is ignored.

Change Order: A legal document that amends the original construction contract for work later added or deleted from the original agreement. Job costing often “discovers” where a Change Order should be obtained, covering the additional costs of changes in the plans.

Completed Contract Method: To account for all income and expenses for a job at the end of the job instead of recognizing income and expenses as the job progresses.

Cost Codes: The numbering systems used for budgeting each phase of the job. The number 3000 is for concrete expense, with 3000L for labor, 3000M for materials, 3000S for subcontracts, 3000E for equipment, and 3000G for other expenses. The industry standard Cost Code numbering system was devised by the Construction Specification Institute (CSI) and is widely adopted in the industry. Cost Codes may have additional letters for Group Codes. (See Group Codes.)

Cost to Complete: An estimate of the amount of money it will take to complete a particular phase of a job. Adding this to the cost to date for a phase results in a total cost for that phase. This number is compared to the budget to determine if there is a potential cost variance.

Costs in excess of billings: To account for costs that have been accrued, but have not yet been billed to the customer. This is a necessary step to adjust income to what has actually been earned on an “accrual” basis.

Group Codes: An appendage to a Cost Code to differentiate floors in a building, units in an apartment, or subcontractors from each other.

Field Reports: A report that lists each phase of each job with room for a project manager to indicate the respective cost to complete or percentage of completion for each phase. This information is then used to calculate the total projected cost for each phase and compares that number with the budget to calculate potential cost variances.

Job Costing: The accounting tool that allows builders to monitor costs of each phase of each job, with reports that show cost variances. It is “the right tool for the job” when it comes to managing a construction business.

Loss: When expenses exceed income. Too many contractors lose money on jobs because they do not monitor costs as they are incurred, waiting until the job is over to determine if they made a profit or suffered a loss. By then, it is too late.

Percentage Method: To account for a job based on how much as been completed. The calculation multiplies each phase of the job with its respective budget by its percentage of completion to get a total percentage completed. This is an Accrual Accounting process.

Profit: When income exceeds expenses. Without a profit, the business will not be able to stay in business.