![]() Job Cost Analysis: Trade Analysis Report

Job Cost Analysis: Trade Analysis Report

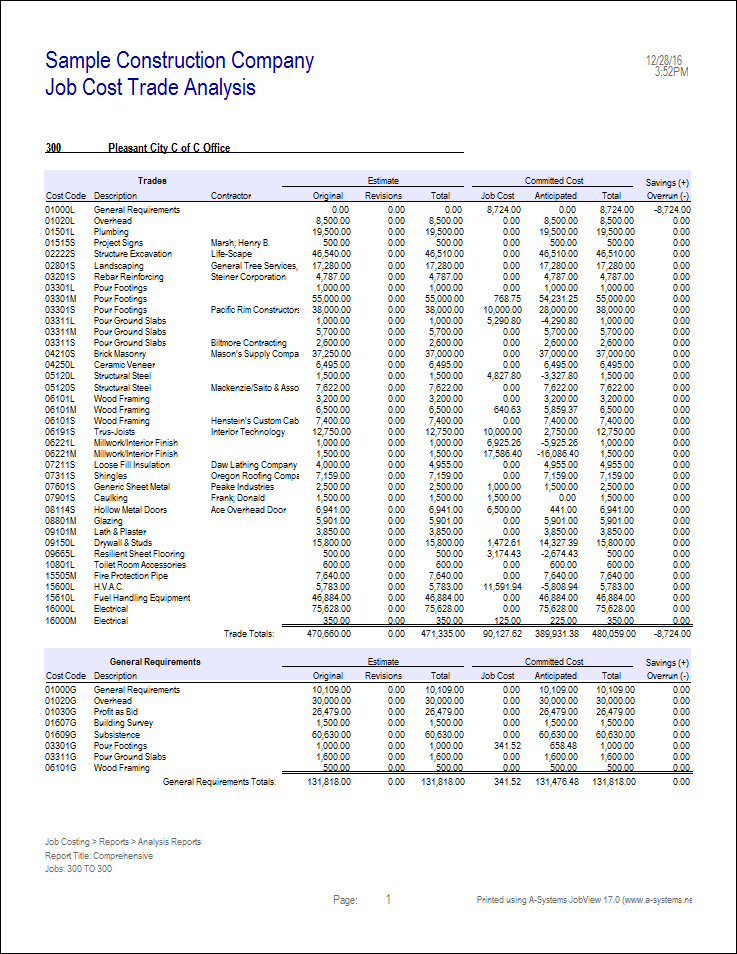

This report contains an analysis by cost code, subtotals by cost type, and a listing of the cost estimates versus the committed costs.

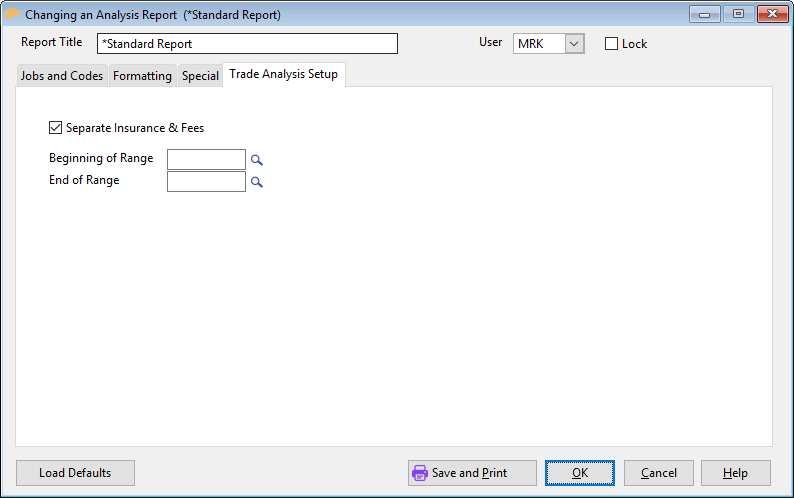

This report is accessible through Job Costing Analysis Reports. To print this report, check the Trade Analysis radio button under the Report Formatting tab. The following tab will come into view.

Separate Insurance & Fees (check box)

Select this option to limit the report by specific Cost Codes.

Begging of Range

Selects the first Cost Code in a range of Cost Codes or a single Cost Code. Enter the Cost Code or press the lookup button and the Cost Code screen comes into view. Highlight the desired record and press the Select button.

End of Range

Selects the last Cost Code in a range of Cost Codes or a single Cost Code. Enter the Cost Code or press the lookup button and the Cost Code screen comes into view. Highlight the desired record and press the Select button.

see Report Format

see Print Options

see Print Order

see Detail Level

see Orientation Level

Report Description - Job Status Report

Report Sample - Job Status Report

Report Description (Detail Format)

Heading

The report heading consists of the report title, date, page number and company name. The limits set at the time of printing are also included.

Cost Code

This is the cost code or job phase. Following the code number is the code type (Labor, Materials, Subcontracts, Equipment or General). If a grouping code is assigned, the code is printed behind the code type.

Cost Code Description

This column contains the name or description of the cost code for the job phase listed.

Contractor

This column contains the name of the Contractor to whom this cost code is assigned.

Estimated Costs

This is the current budget for the job phase.

Committed Cost

This is the actual cost to-date as recorded through the accounting system. This would include amounts charged to the job through Accounts Payable, Payroll, General Ledger and/or other modules. Cost to-date figures are derived directly from the job cost file. In the case of costs accrued through Accounts Payable, this cost to-date field is updated every time an invoice is posted. For this reason, the cost to-date columns on this reports reflect all invoices posted, whether they are paid or not.

Savings Overrun

This field shows the difference (in dollars) between the current costs and the costs that should have been incurred at this point in the phase.