Year-End Procedures

for A-Systems JobView and Visual Bookkeeper Software

Calendar Year End Procedures

Print 1099 FormsAt the end of the calendar year, 1099 forms must be printed and distributed to some of your vendors.

When the program prints 1099s, the forms will be printed for all vendors whose Print 1099 flag is set to print form 1099-NEC, 1099-MISC or form 1099-INT and to whom you have paid more than the specified minimum amount during the calendar year. Before printing 1099s on your purchased forms, you may wish to first preview the 1099 forms and check your figures. Year to-date balances for any vendor may be changed through Vendor Entry or by using a special option in the 1099 printing program menu.

Print W-2 Forms

Another required procedure for calendar year end is printing W-2 forms for employees.

The program can print W-2 and W-3 forms for submission to the government and W-2 forms for distribution to employees. Any of these forms can be printed on purchased forms or on blank paper. There are many printing choices available in the W-2 Printing program. You can also avoid sending paper forms to the government by generating a text file for Electronic Filing.

Fiscal Year End Procedures

At the end of the fiscal year, the year to-date portion of your financial statement must be cleared to make way for transactions posted in the new year. To accommodate the transactions needed to clear the statement, you should create a fiscal period titled YEAR END. This fiscal period should appear after the last fiscal period in your fiscal year. For example, if you have a fiscal calendar year and the last fiscal period of this year is “DEC 2023” with a Begin Date of 12/01/23 and an End Date of 12/31/23, the next fiscal period should be “END 2023.”The procedures for year end processing should follow this pattern:

- Close any jobs which are completed (all billings have been received and all invoices have been paid). Post these transactions to the last period of your fiscal year.

- Make Year-end Adjustments. This includes posting the total year-end Over Billings and Under Billings (found on the year-end bonding report) into your balance sheet accounts. Post these transactions to the last period of your fiscal year.

- * Zero all cost, revenue, and expense accounts in the P&L statement by entering an offsetting debit or credit for each account balance and debiting or crediting the total difference to the Retained Earnings account in the Equity portion of the Balance Sheet. Post these transactions to the YEAR END fiscal period.

- * Re-enter prior years job cost and job revenue figures.

* Steps 3 and 4 can be completed automatically by selecting Year End Closing from the General Ledger main menu.

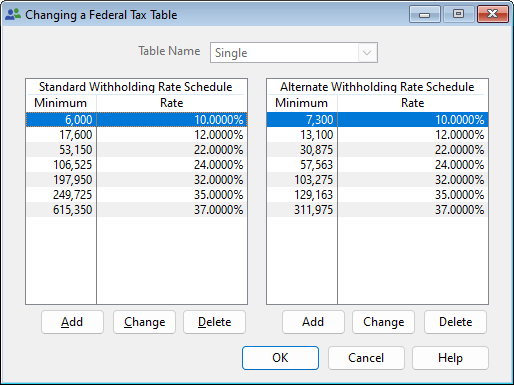

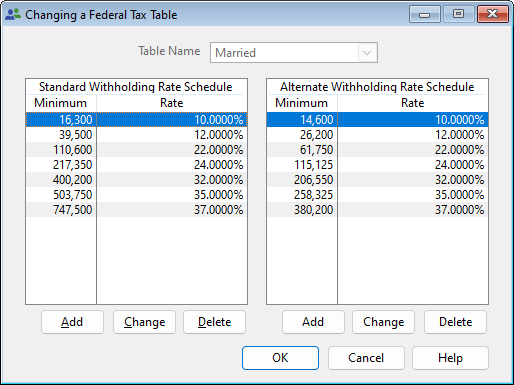

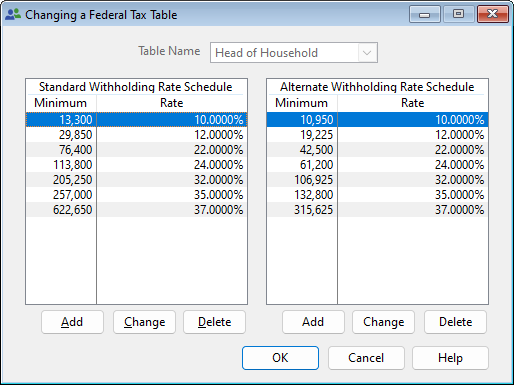

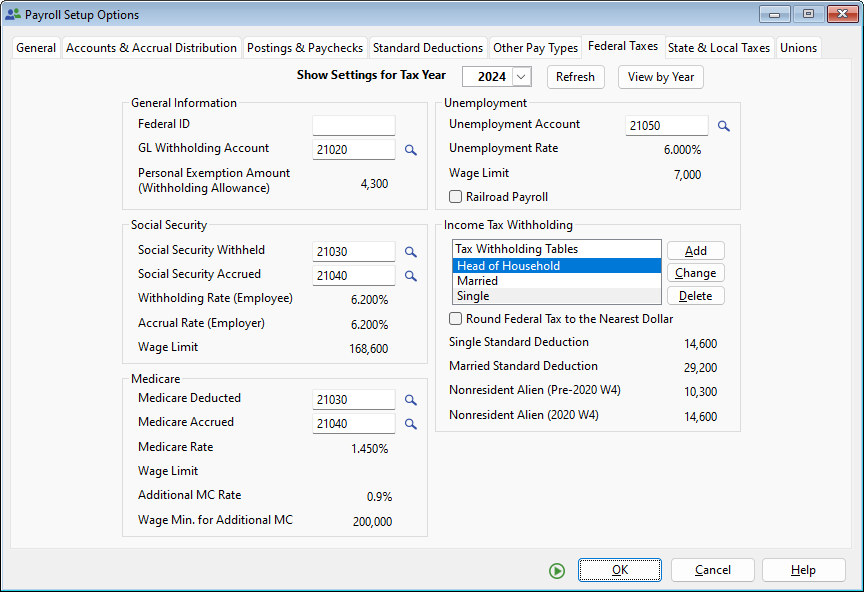

Federal Tax Tables As Of January 2024

The following screens are the tax tables as they should appear in your program. Remember, use your own Federal ID Number and G/L Account numbers.

Justification for these tax table figures can be found in Publication 15-T on the IRS Website.

These tables will be downloaded automatically. For more detailed instructions, go to Technical Bulletin #512

State Tax Tables

Some state tax tables have changed. Please be aware that it is your responsibility to obtain the new tax tables from your state(s) and make the changes in your program. If you need assistance entering the changes to your state tax tables, contact A-Systems for instructions.

A-Systems JobView and Visual Bookkeeper Technical Bulletin #511